How Easy is the Actuarial Science Vee for Stats by Coaching Actuaries

Actuarial Science Program

Predicting the future and managing risk with mathematics.

Quick Links

- Actuarial Science as a Career

- What is an Actuary?

- Actuarial Exams and Financial Assistance

- Actuarial Science Related Courses at DePauw

- Validation by Educational Experience (VEE) Credits

- Internships

- Actuarial Talks and Internship Experience Workshops

- Employment & Job Outlook

- Useful Links

Actuarial Science as a Career

The editors of the Jobs Rated Almanac compile statistics on 250 occupations and rank them based on six key criteria: environment, income, employment outlook, physical demands, security and stress. In the past six editions of the Jobs Rated Almanac, actuary has never been rated lower than fourth.

Compensation depends on experience, employment location and the number of exams passed. A recent survey conducted by D.W. Simpson & Co. found that 80 percent of first-year actuaries with one SOA exam passed were compensated between $42,000 and $53,000 per year (excluding signing bonuses). The salary growth potential for the actuarial profession is one of the highest available. For example, Fellows of the Society of Actuaries with 15 years of experience often earn in excess of $250,000 annually. For more detailed salary and compensation information, visit www.dwsimpson.com/salary.html.

What is an actuary?

Actuaries apply mathematical principles and techniques to solve problems in finance, insurance and related fields. Actuaries are involved with every aspect of the insurance industry and must possess strong mathematical skills and a solid business background to apply their technical knowledge.

Actuarial science is a collection of mathematical and statistical techniques that make it possible to calculate the monetary value of uncertain future events. For example, an insurance company that sells homeowner's insurance must take into account how often houses burn down and what the replacement costs are when setting the insurance premium (yearly payment) for homeowners' insurance. If the premium is set too low, then on average the company will not collect enough money in premiums to cover the replacement costs of the homes it insures. But if the premium is set too high, customers will choose other insurance companies which offer lower rates.

Another example is that the State of Indiana manages a pension fund for its employees. Out of each employee's paycheck a certain percentage is contributed to the fund and this money is invested until the employee retires. At that point the employee begins to receive a monthly pension check which continues until their death. Some questions confronting the managers of the pension plan are:

-

How much money must be invested at the time of retirement in order to be able to make the pension payments until the employee's death? It is not known how long the employee will live, so this must be answered after a careful statistical analysis.

-

What percentage must be taken from the salary each month in order to have the required amount invested at the time of retirement?

-

How should the money be invested in order to strike a balance between risky, high-return investments and reliable investments with lower return?

Actuaries in the Insurance Industry

Most actuaries are employed in the insurance industry, specializing in either life and health insurance or property and casualty insurance. They produce probability tables or use more sophisticated dynamic modeling techniques that determine the likelihood that a potential event will generate a claim. From these tables, they estimate the amount a company can expect to pay in claims. For example, property and casualty actuaries calculate the expected number of claims resulting from automobile accidents, which varies depending on the insured person's age, sex, driving history, type of car, and other factors. Actuaries ensure that the price, or premium, charged for such insurance will enable the company to cover claims and other expenses. This premium must be profitable, yet competitive with other insurance companies. Within the life and health insurance fields, actuaries help to develop long-term-care insurance and annuity policies, the latter a growing investment tool for many individuals.

Actuaries in Finance

Actuaries in other financial service industries manage credit and help price corporate security offerings. They also devise new investment tools to help their firms compete with other financial service companies. Pension actuaries work under the provisions of the Employee Retirement Income Security Act (ERISA) of 1974 to evaluate pension plans covered by that Act and report on the plans' financial soundness to participants, sponsors, and Federal regulators. Actuaries working for the government help manage social programs such as Social Security and Medicare.

Actuaries may help determine company policy and may need to explain complex technical matters to company executives, government officials, shareholders, policyholders, or the public in general. They may testify before public agencies on proposed legislation that affects their businesses or explain changes in contract provisions to customers. They also may help companies develop plans to enter new lines of business or new geographic markets by forecasting demand in competitive settings.

Actuaries in Consulting

Consulting actuaries provide advice to clients on a contract basis. The duties of most consulting actuaries are similar to those of other actuaries. For example, some may evaluate company pension plans by calculating the future value of employee and employer contributions and determining whether the amounts are sufficient to meet the future needs of retirees. Others help companies reduce their insurance costs by lowering the level of risk the companies take on. For example, they may provide advice on how to lessen the risk of injury on the job. Consulting actuaries sometimes testify in court regarding the value of potential lifetime earnings of a person who is disabled or killed in an accident, the current value of future pension benefits (in divorce cases), or other values arrived at by complex calculations. Some actuaries work in reinsurance, a field in which one insurance company arranges to share a large prospective liability policy with another insurance company in exchange for a percentage of the premium.

Actuarial Exams And Financial Assistance

In the United States, actuaries achieve professional status by passing a series of examinations administered by the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS). The first few exams are the same, but later exams differ between these two professional groups.

Actuaries specializing in life insurance, health insurance, or retirement systems take the SOA exams. Those practicing in the property and casualty insurance area take the CAS exams. In each society, the designation of "associate" is awarded after approximately two-thirds of the exams are passed. Actuaries achieve "fellowship" standing after completing all exams. Fellowship in either society is the highest professional designation an actuary can attain.

Undergraduate students generally pass several exams while in college if they want to be an actuary after graduation, at least passing one exam, thereby qualifying for attractive employment opportunities. Actuaries continue to take exams while working, eventually attaining professional designations such as Associate and Fellow (the highest designation). Detailed information can be found at the Society of Actuaries, Casualty Actuarial Society, and Be An Actuary.

Actuarial Exam Reimbursement Program and Scholarships

The Roger Nelson Endowed Fund provides financial assistance to students who pass the actuarial exams. For each exam passed, students get 50% of the exam fee reimbursement.

Actuarial Science Related Courses at DePauw

We offer the following Actuarial Science related courses in the Math Department. For details of actuarial science courses, please contact Dr. Zhixin Wu .

Math 331 Mathematics of Compound Interest (Offered once a year)

A mathematical treatment of measurements of interest and discount, present values, equations of value, basic annuities, more general annuities, amortization and sinking funds, bonds and other securities, yield rates, the term structure of interest rates, duration, convexity and immunization. This course covers SOA Exam FM material.

Prerequisite: Math 152 Calculus II

Math 332 Seminar in Financial Math (Offered once a year)

This is a problem-solving seminar. The problems discussed in the seminar provide students with a better understanding of the actuarial field by exposing students to the professional application of actuarial science and by providing resources for students taking actuarial exams. Techniques and strategies for solving difficult problems are also introduced in the seminar. The seminar also includes an introduction of financial instruments, the determinants of interest rates, an alternative way to approximate the effect of change in interest rates, and interest rate swaps. This course is of great assistance for students who are preparing for the actuarial exam (FM).

Prerequisite: Math 331, which may be taken concurrently.

Math 336 Introduction to Financial Engineering (Offered once every other year)

The course builds on mathematical models of bond and stock prices and focuses on the mathematical modeling of financial derivatives. It covers several major areas of financial derivative pricing modeling, namely: Efficient market and No-Arbitrage Principle; basics of the fixed-income instrument and risk-free asset; Risk-neutral Probability and Risk-Neutral Pricing; Black-Scholes' arbitrage pricing of options and other derivative securities; Numerical Methods like Binomial Tree for derivative pricing; the Greeks and Hedging using derivatives. Assuming only a basic knowledge of probability and calculus, it covers the material in a mathematically rigorous and complete way at a level accessible to second or third-year undergraduate students. This course is suitable not only for students of mathematics, but also students of business management, finance and economics, and anyone with interest in finance who needs to understand the underlying theory.

Prerequisites: Math 151 (Calculus I) and Math 141 (Stats for Professionals) or Econ 350 (Statistics for Economics and Management) and Econ 100 (Introduction to Economics)

Math 441 Probability (Offered once a year)

The Basic Principal of Counting, Permutations, Combinations, Axioms of Probability, Conditional Probability and Independence, Discrete and Continuous Random Variables, density and their distributions, Joint Distributed Random Variables, Properties of Expectation, Moment generating functions, Limit Theorem including Chebyshev's inequality and Central Limit Theorem. This course covers SOA Exam P material. Prerequisite: Math 152 Calculus II

Math 442 Probability Problem Seminar (Offered once a year)

The seminar will include the topics of multivariate distributions, order statistics, the law of large numbers, basic insurance policies, frequency of loss, frequency distribution, severity, severity distribution, characteristics of an insurable risk, measurement of risk, economics risk, expected value of loss, loss distribution, premium payment, claim payment distribution, limits on policy benefit (deductible, maximum, benefit limits) and role of actuaries. After studying, students will be able to demonstrate a solid foundation in probability by their ability to solve a variety of basic and advanced actuarial practical problems. Prerequisite: MATH 441, which may be taken concurrently.

Math 494 (Actuarial Science and Financial Math Case Studies) (offered every other spring starting Spring 2021)

This course is the senior seminar for actuarial science majors. It is primarily based on lectures and group discussions. Students participating in this senior capstone course are exposed to case studies in Actuarial Science and Financial Mathematics. Students will work in groups to complete various projects such as mortality and lapse studies in insurance and use public data in the Society of Actuaries, Casualty Actuarial Society, and other resources to model and price financial derivatives. Students will apply techniques from courses to real-world data using data analytic methods and tools to complete research.

Prerequisites: The prerequisites of this course are two core actuarial science courses (Math 331 Theory of Compound Interest or Math 336/Econ 390 Introduction to Financial Engineering, and Math 441 Probability) plus one upper-level statistics course offered in the Math Department (Math 341 Statistics Model Analysis, Math 348 Introduction to Statistical Computing) or Econ department (Econ 385 Regression and Simulation for Economics and Management, Econ 450 Econometrics).

Validation by Educational Experience (VEE) credits

The VEE requirement is jointly sponsored by the Society of Actuaries (SOA), Casualty Actuarial Society (CAS) and Canadian Institute of Actuaries (CIA). There are three VEE topics:

- Economics (Microeconomics & Macroeconomics)

- Accounting and Finance

- Mathematical Statistics

The VEE topics are not prerequisites for the preliminary exams (Exams P, FM, MLC, MFE and C) and may be fulfilled independently of the exam process. However, you must pass two SOA or CAS actuarial exams before applying to have your VEE credit added to your record.

All three VEE topics are required for both the ASA (Associate of the Society of Actuaries) and FSA (Fellow of the Society of Actuaries) designations.

The CERA (Chattered Enterprise Risk Analyst) designation requires only the VEE Economics topic.

The following courses at Econ Department have been evaluated and approved by SOA for VEE credits:

- VEE credit in Economics: Econ 294 Intermediate Microeconomics Theory & Econ 295 Intermediate Macroeconomic Theory

- VEE credit in Accounting and Finance: Econ 220 Introduction to Financial Accounting and Econ 393 Corporate Finance

- VEE Credit in Mathematical Statistics: Math 247 Mathematical Statistics

If you get B- or better in these two courses, you are eligible to apply for the VEE Economics credit. More details for the application process, please see http://www.soa.org/education/exam-req/edu-vee.aspx

Internships

Students who want to be an actuary are encouraged to participate an Actuarial Internship Program in winter term or in summer. From the actuarial internship programs, you will have the opportunity to experience what life is like as an actuary. You will be involved in important, relevant work from day one and gain invaluable experience to support your career development. There are a few excellent annual Actuarial Internship Programs in the States, such as:

- New York Life Summer Actuarial Internship Program

- Hartford Undergraduate Internship Program

- Penn Mutual Summer Internship Program

- State Farm Actuarial Internship Program

More information and directories can be found on SOA Actuarial Training Programs.

DePauw Resources

DePauw provides various resources to help our actuarial students to find internship and jobs. We invite actuaries from local insurance companies and actuarial consulting firms to campus visit and recruiting each semester. Please see our current and past event posters.

-

DePauw Career Service center, located at Hubbard Center in the Student Union Building

-

The Philadelphia Center (TPC)

Career Planning

1. Sloan Foundation Career Planning

2. Sloan Foundation-Actuarial Science

3. Career Cast-Actuary Jobs

4. Jobs4Actuary

5. CAS Career Center

6. Monster job search

Actuarial Talks and Internship Experience Workshops

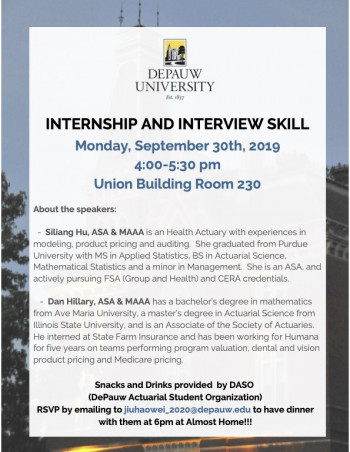

| Sept. 30, 2019 Workshop |  |

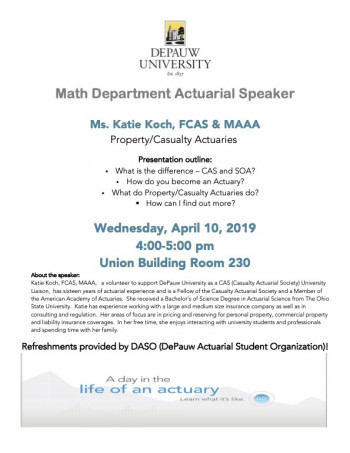

| April 10, 2019 Recruiting Event |  |

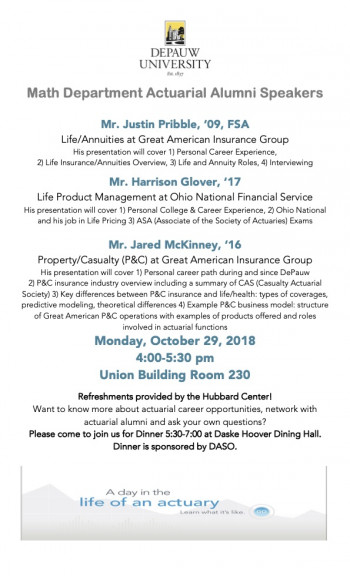

| October 29, 2018 Workshop |  |

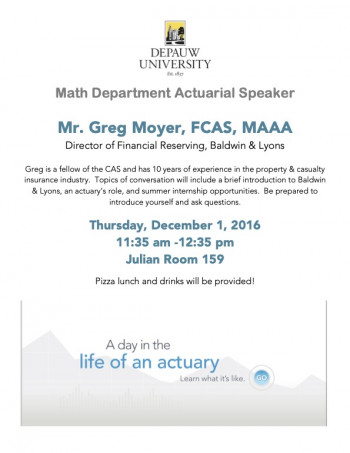

| December 1, 2016 Recruiting Event |  |

| Sept. 29, 2015 Recruiting Event | |

| Oct. 13, 2015 Workshop | |

| Nov. 10, 2015 Recruiting Event | |

Employment and Job Outlook

Actuaries held about 18,000 jobs in 2006. Over half of all actuaries were employed by insurance carriers. Approximately 21 percent work for professional, scientific and technical consulting services. Others worked for insurance agents and brokers and in the management of companies and enterprises industry. A relatively small number of actuaries are employed by government agencies.

Employment of actuaries is expected to grow rapidly in the next ten years. Job opportunities should remain good for those who qualify, because the stringent qualifying examination system restricts the number of candidates.

Job prospects. Opportunities for actuaries should be good, particularly for those who have passed at least one or two of the initial exams. In addition, a small number of jobs will open up each year to replace actuaries who leave the occupation to retire or transfer new jobs. Candidates with additional knowledge or experience, such as computer programming skills, will be particularly attractive to employers. Most jobs in this occupation are located in urban areas, but opportunities vary by geographic location.

Useful Links

- BeAnActuary.org

- Actuary.com

- Society of Actuaries Home Page

- Casualty Actuarial Society Home Page

- American Academy of Actuaries Home Page

- Conference of Consulting Actuaries Home Page

- American Society of Pension Actuaries Home Page

- Canadian Institute of Actuaries Home Page

- Institute of Actuaries (UK) Home Page

- International Actuarial Association (IAA)

- Actuarial Outpost (AO)

- The Actuary (The magazine of the Institute and Faculty of Actuaries)

Any questions you have related to Actuarial study, please feel free to contact Professor Zhixin Wu (zhixinwu@depauw.edu, Julian 310).

Source: https://www.depauw.edu/academics/departments-programs/mathematics/studentresources/actuarial/

Post a Comment for "How Easy is the Actuarial Science Vee for Stats by Coaching Actuaries"